family_restroomParents

Do you lack the desire, time and energy to carry your children to save money? Perhaps you also lack the financial leeway? Does it annoy you to be asked again and again at every birthday, Christmas, etc. what present would be suitable? And then cash gifts too...

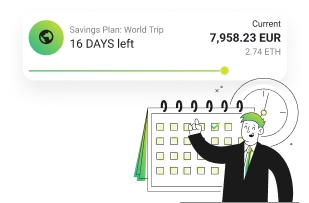

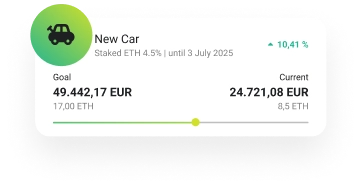

Yes, I want to create a framework in which I and others can save for my child. But practical, simple and future-proof. Is that possible? Yes, with urble!

redeemGodparents

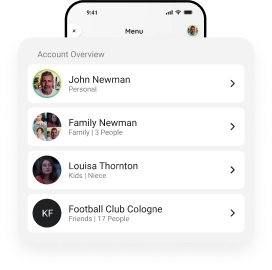

Is your role as an occasional giver of gifts and money perhaps not enough for you? Do you miss the common thread and transparency of what happens with your gifts? Would you like to give your godchild more than just a few gifts along the way?

Then just take responsibility yourself and create an urble account for your godchild.

volunteer_activismGrandparents

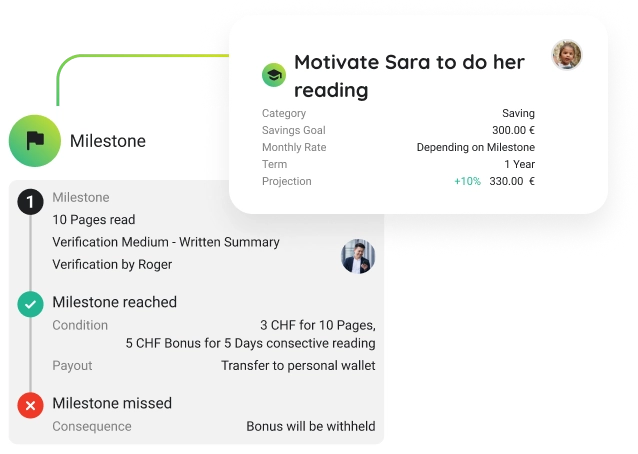

You want

- your grandchildren to be on a solid financial footing in the long term

- to learn about saving through play and understand how important it is for their self-determined future?

- help them achieve their savings goals

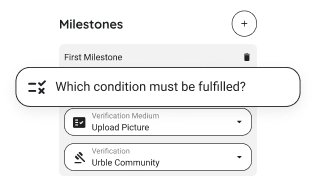

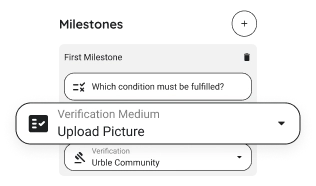

- set them additional real-life incentive goals and reward them when they reach them

Then opening an urble account is just the thing for your grandchildren.